idaho estate tax return

Check below to see if you qualify. Letter to Internal Revenue Service transmitting Federal Estate 346 Tax Return 30.

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset

The amount is based on the most recent approved 2019 tax return information on file at the time the rebate is issued.

. Idaho has no state inheritance or estate tax. There is an 1170 million million exemption for the federal estate tax for deaths in 2021 increasing to 1206 million in 2022. Using tax software for free tax year 2021 The State of Idaho has partnered with the IRS and certain tax software companies to allow qualifying taxpayers to prepare their federal and Idaho returns for free.

Its one of the following whichever is greater. Or jointly held property do not require the filing of an estate tax return. Permanent Building Fund Tax individuals and businesses pay a 10 per year tax.

Corporate income tax returns. Payment of any additional tax due together with any applicable interest and penalty must accompany the Idaho return. Sign in to the Community or Sign in to TurboTax and start working on your taxes.

Due the 20 th day of the month following the tax period the tax period may be monthly or quarterly Federal Form 1099 to Tax Commission. Include Form PTE-12 with the return if the trust or estate files as a pass-through entity. Sarah FisherMar 03 2020.

Taxes are determined according to a propertys current market value minus any exemptions. Letter to Internal Revenue Service transmitting Federal Fiduciary 348 Income Tax Return 32. Letter to IRS requesting prompt audit of estate tax return 347 31.

Federal estate tax return includes any federal form or other action which establishes changes or amends either the. A copy of any filing by the estate that establishes changes or amends the estates federal tax liability shall be filed no later than sixty 60 days after the document is filed with the Internal. Electricity Kilowatt Hour Tax.

Find IRS or Federal Tax Return deadline details. The North Dakota estate tax is a pickup tax based upon the credit for state death taxes as computed on the federal estate tax return. You can expect your refund about seven to eight weeks after you receive an acknowledgment that we have your return.

If the Idaho Fiduciary Income Tax Return Form 66 is filed within the automatic extension period but less than 80 of the current year tax liability or 100 of the total tax paid last year was paid by the original due date an extension penalty will apply. Letter to Idaho State Tax Commission transmitting Tentative Idaho 345 Transfer and Inheritance Tax Return 29. For example homeowners of owner-occupied property.

Enter the total of Idaho distributable income from Form PTE-12 columns b c and e. In accordance with Sections 63-105 and 14-539 Idaho Code the State Tax Commission shall promulgate rules. Get an Identity Protection PIN IP PIN Pay.

Most homes farms and businesses are subject to property tax. Line 5 Income Distribution Deduction Enter the amount of the deduction for distributions to beneficiaries. 50 per taxpayer and each dependent.

Operating Property Tax public utilities railroads. Do not enter the total. The decedent and their estate are separate taxable entities.

You can apply online for this number. Idaho Estate and Transfer Tax Return must immediately be filed along with a copy of the amended Federal Estate Tax Return. 350104 - IDAHO ESTATE AND TRANSFER TAX ADMINISTRATIVE RULES.

However like all other states it has its own inheritance laws including the ones that cover what happens if the decedent dies without a valid will. 9 of the tax amount reported on Form 40 line 20 or line 42 for eligible Idaho residents and service members using Form 43. The information from the federal estate tax return must be used to complete the state estate tax return.

Due the 15th day of the 4th month following the close of the fiscal tax year. Idaho has no estate tax. Also the Idaho State Tax Commission sets property tax values for operating property which consists mainly of public utilities and railroads.

Enter the total gross estate from line 1 page 1 of the Federal Form 706. IDAHO ADMINISTRATIVE CODE IDAPA 350104 - Idaho Estate Transfer State Tax Commission Tax Administrative Rules Page 4 IAC 2011 01. Be aware that the IRS and the respective State Tax Agencies require you to e-file a Federal Income Tax Return at the same time you e.

Apply for an Employer ID Number EIN Check Your Amended Return Status. Before filing Form 1041 you will need to obtain a tax ID number for the estate. Farming and ranching production exemption.

A homeowner with a property in Boise worth 250000 would then pay 2003 for their annual property taxes. Due April 15 for calendar year filers. This article goes over topics that include probate how to successfully create a valid will in Idaho and what happens to your property if you die without a.

Written notice of any changes in the federal estate tax liability must be submitted to the Idaho State Tax Commission along. Due the last day of February. Then click a provider to view and use the software.

A homeowner with the same home value of 250000 in Twin Falls Twin Falls County would be charged 1935 for property taxes at a rate of. The final Idaho return for the trust or estate. An estates tax ID number is called an employer identification number or EIN and comes in the format 12-345678X.

You can expect your refund about 10 to 11 weeks after we receive your return. A filing is required for estates with combined gross assets and prior taxable gifts exceeding 1500000 in 2004 - 2005. To put this into perspective a home in Boise Idaho Ada County has a property tax rate of 801.

Messages left on the estate tax lines will be monitored and callers will receive a response as soon as possible. Fiduciary - An automatic six-month extension of time to file is granted until 6 months after the original due date of the return. Oil and Gas Production Tax.

500 South Second Street. Why sign in to the Community. We must manually enter information from paper returns into our database.

If your estate is large enough you still may have to worry about the federal estate tax though. Understand typical refund time frames. You can prepare and e-file your IRS and Idaho State Tax Return eg resident nonresident or part-year resident returns now.

The Idaho tax filing and tax payment deadline is April 18 2022. They can also e-file both returns for free.

Banking Suvidha Income Tax Return Itr Pan Aadhaar Tax Saving F Personal Injury Lawyer Injury Lawyer Estate Planning Attorney

Greystone Park Mansion 905 Loma Vista Drive Beverly Hills California Usa Mansions House Design Beverly Hills

Can My Accountant Release My Tax Returns Findlaw

Ohio Quit Claim Deed Form Quites Ohio Marital Status

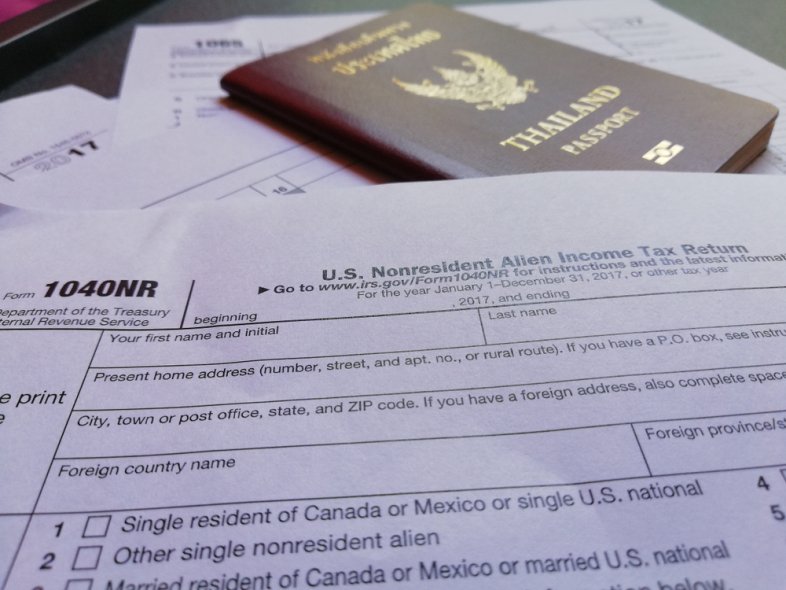

What Non U S Citizens Should Know About Filing Taxes Mybanktracker

:max_bytes(150000):strip_icc()/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Idaho Estate Tax Everything You Need To Know Smartasset

Where S My State Refund Track Your Refund In Every State

Here S The Average Irs Tax Refund Amount By State Gobankingrates

How To File Taxes For Free In 2022 Money

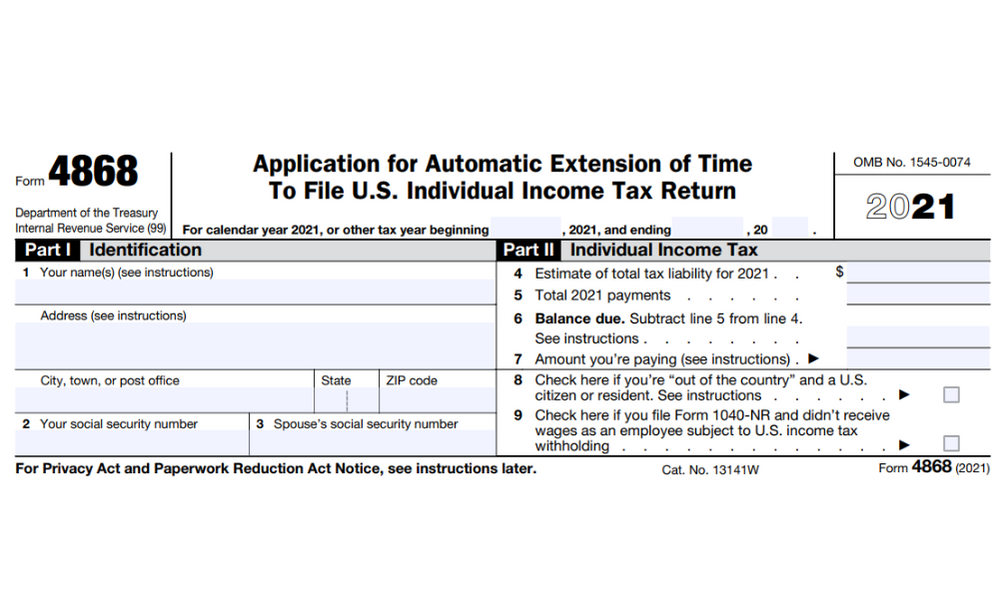

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Deducting Property Taxes H R Block

You Made A Mistake On Your Tax Return Now What

Will The Irs Extend The Tax Deadline In 2022 Marca

Filing An Idaho State Tax Return Things To Know Credit Karma Tax

Irs Says Key Tax Forms Will Be Ready For Tax Season But There S No Start Date Yet